The Foundations in Personal Finance Chapter 9 Answer Key PDF provides a comprehensive and engaging guide to the fundamental principles of personal finance, empowering individuals to make informed financial decisions and achieve their financial goals. This chapter delves into the intricacies of budgeting, savings, investments, credit management, and more, offering practical insights and actionable advice to navigate the complexities of personal finance.

With clear explanations, real-world examples, and practical exercises, the Foundations in Personal Finance Chapter 9 Answer Key PDF serves as an invaluable resource for students, financial professionals, and individuals seeking to enhance their financial literacy. Whether you are just starting your financial journey or looking to refine your existing strategies, this chapter provides the essential knowledge and guidance to help you achieve financial success.

Introduction

Personal finance foundations are essential for individuals to achieve financial well-being and security. Chapter 9 of this book covers key concepts and strategies to help individuals establish a solid financial foundation.

This chapter focuses on the following topics:

- Budgeting and financial planning

- Savings and investments

- Credit and debt management

- Consumer protection and financial literacy

- Real estate and homeownership

- Insurance and risk management

- Estate planning

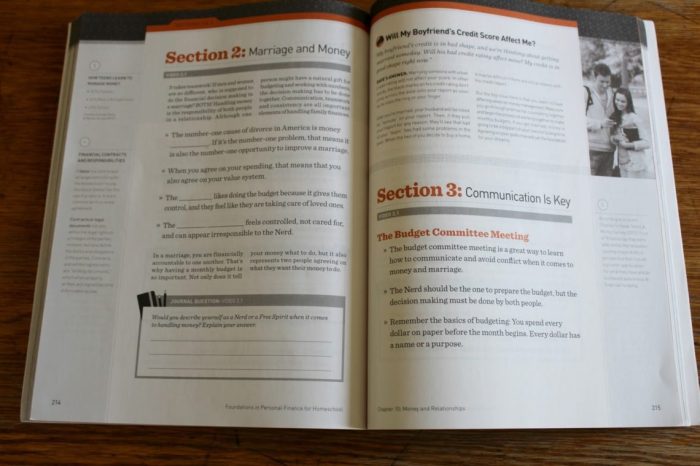

Budgeting and Financial Planning: Foundations In Personal Finance Chapter 9 Answer Key Pdf

Budgeting is the process of creating a plan for managing your income and expenses. It helps you track your spending, set financial goals, and make informed financial decisions.

Financial planning involves setting long-term financial goals and developing a strategy to achieve them. It includes planning for retirement, education, major purchases, and other financial milestones.

Budgeting Techniques, Foundations in personal finance chapter 9 answer key pdf

- 50/30/20 rule

- Zero-based budgeting

- Envelope budgeting

Importance of Financial Planning

- Achieve financial goals

- Avoid debt and build wealth

- Secure financial future

Savings and Investments

Saving is the process of setting aside money for future use. Investing is the process of using your savings to earn a return.

Types of Savings Accounts

- Checking accounts

- Savings accounts

- Money market accounts

- Certificates of deposit (CDs)

Benefits of Savings Accounts

- Earn interest on your money

- Provide a financial cushion for emergencies

- Help you reach your financial goals

Principles of Investing

- Diversification

- Time in the market

- Compound interest

Investment Options

- Stocks

- Bonds

- Mutual funds

- Exchange-traded funds (ETFs)

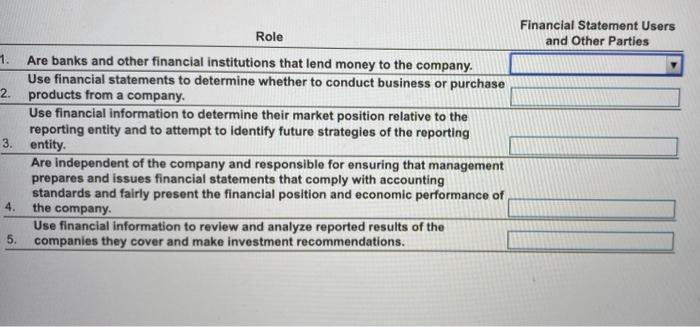

Credit and Debt Management

Credit is a form of borrowing money. Debt is the amount of money you owe. Managing credit and debt effectively is crucial for maintaining a healthy financial situation.

Types of Credit

- Credit cards

- Personal loans

- Student loans

- Mortgages

Impact of Credit on Financial Health

- Credit score

- Interest rates

- Debt-to-income ratio

Strategies for Managing Debt

- Create a debt repayment plan

- Consolidate your debt

- Negotiate with creditors

Consumer Protection and Financial Literacy

Consumer protection laws and regulations are designed to protect consumers from unfair and deceptive practices.

Financial literacy is the ability to understand and manage your personal finances. It includes knowledge of budgeting, saving, investing, and credit management.

Importance of Consumer Protection

- Prevents fraud and scams

- Ensures fair treatment in the marketplace

- Provides recourse for consumers who have been wronged

Ways to Enhance Financial Literacy

- Take financial education courses

- Read books and articles about personal finance

- Use online resources and tools

Real Estate and Homeownership

Real estate is land and the buildings on it. Homeownership is the process of owning a home.

The real estate market is complex and can be influenced by a variety of factors. Homeownership involves significant financial responsibilities.

Overview of the Real Estate Market

- Types of real estate

- Market trends

- Factors affecting property values

Financial Considerations of Homeownership

- Down payment

- Mortgage payments

- Property taxes

- Homeowners insurance

Responsibilities of Homeownership

- Maintenance and repairs

- Landscaping

- Utilities

Insurance and Risk Management

Insurance is a contract that provides financial protection against certain risks. Risk management involves identifying and mitigating potential risks to your financial well-being.

Types of Insurance

- Health insurance

- Life insurance

- Disability insurance

- Homeowners insurance

- Auto insurance

Role of Insurance in Financial Planning

- Provides financial security

- Protects against unexpected events

- Preserves assets

Strategies for Managing Risk

- Diversification

- Hedging

- Insurance

Estate Planning

Estate planning is the process of planning for the distribution of your assets after your death.

Estate planning involves creating a will or trust, appointing an executor, and considering tax implications.

Importance of Estate Planning

- Ensures your wishes are carried out

- Protects your loved ones

- Reduces estate taxes

Estate Planning Tools

- Wills

- Trusts

- Durable power of attorney

- Living will

FAQ Overview

What are the key concepts covered in Chapter 9 of Foundations in Personal Finance?

Chapter 9 covers budgeting techniques, financial planning, savings accounts, investing principles, credit management, and debt reduction strategies.

How can I use the Foundations in Personal Finance Chapter 9 Answer Key PDF to improve my financial literacy?

The answer key provides detailed explanations, examples, and exercises to help you understand and apply the concepts covered in Chapter 9, enhancing your financial knowledge and decision-making abilities.

Is the Foundations in Personal Finance Chapter 9 Answer Key PDF suitable for individuals with no prior financial knowledge?

Yes, the chapter and answer key are designed to be accessible to individuals of all financial backgrounds, providing a clear and comprehensive introduction to the fundamentals of personal finance.